Legal blog

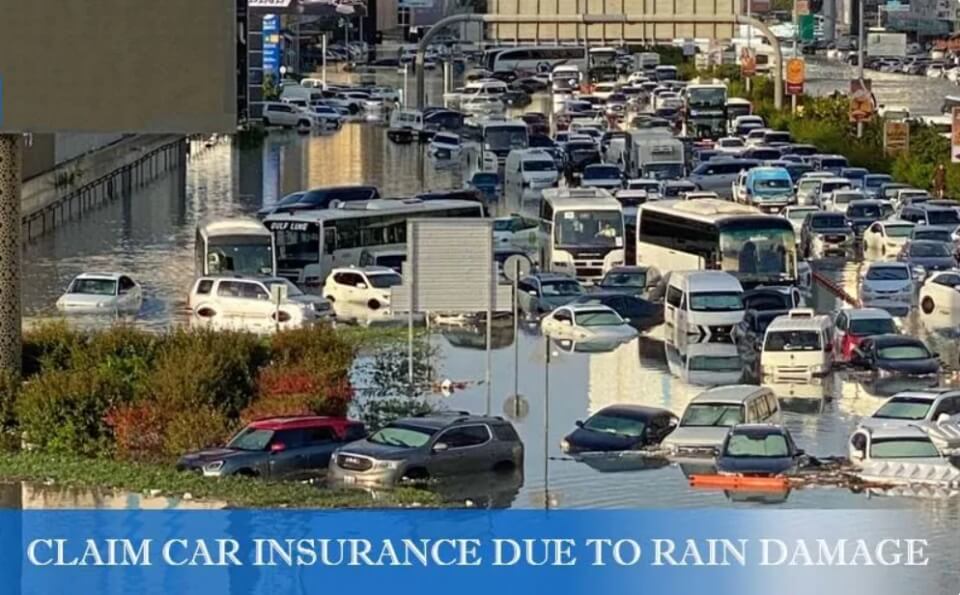

Rejecting Vehicle Damage Claims by Insurance Companies in the 2024 Floods

In the event of vehicle damage caused by flooding in 2024, vehicle owners who hold valid motor insurance policies may find their claims rejected by insurance companies on technical grounds. This can understandably cause anxiety and concern for the policyholder, who may be seeking to understand their legal options and remedies.

Insurance companies may reject claims for a variety of reasons. However, with justifiable reasons and proper legal guidance, policyholders can successfully challenge these rejections. Below are some common grounds for claim rejection and potential arguments a customer may use to resist them:

1. Attempting to Start the Engine in a Waterlogged Area (Hydrostatic Lock)

While insurers may deny claims on the basis that the engine was started in a waterlogged area, the customer's actions can often be justified depending on the circumstances.

2. Delay in Reporting the Incident to Authorities or Insurer

Rejection based on a delayed report is not always justifiable. Each case should be considered on its own merits, and a routine rejection may be challenged.

3. Parking or Driving in a Waterlogged Area or Flooded Road

Insurance companies may claim that parking or driving in such conditions invalidates the coverage. However, if the customer's actions were reasonable under the circumstances, this rejection can be contested.

4. Pre-existing Damage that Contributed to or Aggravated the Loss

Insurers may argue that pre-existing damage led to the claimed loss. However, customers can often negate this argument with appropriate evidence and expert testimony.

5. No Driving License or Invalid Driving License

A claim may be rejected if the driver did not hold a valid license at the time of the incident. Nonetheless, there may be valid reasons to contest this rejection, depending on the specifics of the case.

6. Other Reasons

Insurance companies may cite additional grounds for rejection. If these reasons appear unreasonable or unjustified, they can be legally challenged.

In summary, it is recommended to consult a legal professional who specializes in insurance law and is committed to providing expert legal assistance and advisory services to clients facing rejected claims. We at Kaaseb Mohamed Al Hassani Advocates & Legal Consultancy work diligently to ensure that our client's rights are protected and that they receive the compensation they are entitled to under their insurance policies.

Written by:

Kaaseb Mohammed AlHassani | Kaaseb Mohamed Alhassani Advocates and Legal Consultancy

Currently, there is no information to display in this section.

This publication is for general information purposes only. It does not purport to provide comprehensive full legal or other advice.

Legal Advice Middle East and the contributors accept no responsibility for losses that may arise from reliance upon information contained in this publication. This publication is intended to give an indication of legal issues upon which you may need advice.

Full legal advice should be taken in due course from a qualified professional when dealing with specific situations.