Questions & Answers

How to settle an outstanding balance of credit card to avoid legal action?

I still have an outstanding amount balance on my credit card in Dubai and the last payment was made 7 years ago.

I was not able to pay in installments as I lost my job and went back to my home country and have not returned to the UAE.

How can I settle the amount to avoid a ban and is the amount still valid or the bank is insured on the outstanding amount?

Hello dear questioner,

The matter here depends on the amount and the bank’s procedures.

There may be an enforcement file opened against you by the bank. In this case, you will be banned from traveling and an arrest order will be imposed on you, but we need more details.

Please share your WhatsApp number.

Dear Questioner,

The bank still reserves the right to file a civil claim case.

Please email us the details, such as what bank, what is the total outstanding, and if you have given the bank a guarantee cheque or not.

When was the last payment?

We will review your answers and advise you on the possible resolution.

Thank you!

Dear valued customers,

We can perform a complete scan of all UAE systems to check whether or not you have a status or ban and recommend the best approach to resolve it.

The service price is 1000 dirhams. If you are interested, please send us a copy of your passport or Emirates ID via WhatsApp.

Dear Questioner,

Thank you for reaching out to me with your question regarding your outstanding credit card balance in Dubai.

In situations like yours, it's important to note that while the debt might still be valid, the UAE has a statute of limitations on debt collection.

Typically, this period is 15 years, but certain factors could affect this. If the bank hasn't taken any legal action within this period, they might not be able to enforce the debt through the courts.

However, the bank might still attempt to recover the debt through negotiations or settlement offers.

As for settling the amount, it's crucial to approach this strategically to avoid any legal complications or travel bans in the future.

The bank may be willing to negotiate a settlement or payment plan, especially if you can demonstrate your current financial situation.

Regarding the bank's insurance, it varies, but generally, banks do try to recover outstanding debts directly from the debtor.

I strongly recommend that we discuss your specific situation in more detail to explore the best course of action and ensure that any settlement is handled properly.

Please feel free to reach out to me through WhatsApp or phone at [-------] so we can discuss this further.

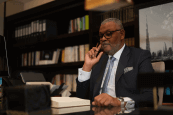

Best regards,

Suhail Rana

You are committed to what was agreed upon with the bank and to paying the debt on its due dates, as the bank has nothing to do with your private business.

You can contact the bank to arrange a payment schedule for those debts.