المدونة القانونية

IBAN Number and Bank Transfers

Simply put, a bank transfer involves moving money from one account to another, either within the same bank or to another bank, domestically or internationally. The process is considered legally complete when the sender's account is debited, and the recipient gains ownership of the funds.

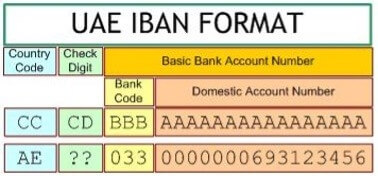

In the past, transfers relied heavily on the recipient's name as stated in the request and banks were obligated to make the transfer based on the names. However, the focus has shifted recently and became essentially dependent on numbers rather than names, particularly the IBAN (International Bank Account Number).

Banks now only proceed with transfers based on the IBAN provided. The transfer is carried out on that basis by the banks involved in the transfer process, whether it is the bank requesting the transfer or the bank beneficiary of the transfer if the two accounts are in two different banks.

These banks do not bear any legal responsibility if it turns out that the transferor made a mistake in entering the correct IBAN number or that the IBAN number he entered belongs to a party other than the party to whom he actually wanted to transfer the amount.

In disputes related to bank transfers, the Dubai Court of Appeal ruled that banks were not responsible and stated explicitly in one of its rulings the following:

“Therefore, there will be no error on the part of the bank, even if the account holder to which the transfer was made, which is (……………) differs.” Regarding the name mentioned in the transfer request, this is due to the appellant’s mistake as long as the bank made the transfer to the same account number it has and which was included in the transfer request submitted to it by the appellant, since the account number is what matters and the name does not have a status in the world of numbers, and when that was The error corner is not available on the bank side...”

In another case, Cassation Appeal No. 702 of 2023 Commercial dated 10/30/2023, the Dubai Court of Cassation affirmed the same principle by saying:

“And it adds, in response to what the appellant claims against the appealed ruling, that he ignored the error in which the appellant committed, namely the lack of caution and caution on the part of the appellant due to the clear and fundamental difference in the entire name and not just in a partial or letter of it. It is an objection that is rejected because the terms and conditions issued by the bank The Emirates Central Bank regarding the Emirates Money Transfer System issued in January 2019, which stated that the UAIFTS 3.0 system is the basis of the system for executing money transfers, and the customer who makes the transfer and the company that initiates the transfer process are both solely responsible for the accuracy of entering the information and the success of the transfer process. In this case, the role of the beneficiary bank is limited to depositing the amount into the beneficiary’s account based on the information provided by the transferor/to the party initiating the transfer or returning the money immediately (instantly) to the originator without retaining the funds, and the party making the transfer or the originator of the transfer bears sole responsibility. On the accuracy of the entries provided in the payment instructions, to the effect that the responsibility for entering data and information is on the party originating the transfer and not on the bank, and that the basis for this is the data on the beneficiary’s account number that the transfer maker writes down).

In light of what was concluded in previous judicial rulings regarding the absence of responsibility of banks if they adhere to the IBAN number included in the transfer request by the client requesting the transfer, this places the responsibility of individuals and companies dealing with banks to exercise due diligence and adequate verification of the authenticity of the IBAN number that they record in requests.

Bank transfer to the party in whose account they actually want the transfer to be deposited, in order to protect their money and their legal position in the event of a dispute over the validity of implementing the transfer or not.

Written by:

Nasir Salman | Jassim Ali Al Haddad Lawyers and Legal Consultants

لا توجد حاليًا معلومات لعرضها في هذا القسم.

هذا المنشور لعرض المعلومات العامة فقط، ولا يهدف لتقديم استشارة قانونية شاملة أو أي نوع آخر من الاستشارات.

لا تتحمل شركة ليجال أدفايس ميدل إيست والمساهمون مسؤولية أي خسائر قد تنجم عن الاعتماد على المعلومات المذكورة في هذا المنشور. هذا المنشور يهدف فقط إلى الإشارة إلى المسائل القانونية التي تحتاج إلى طلب الاستشارة بشأنها.

لا بد من الحصول على استشارة قانونية شاملة في الوقت المناسب من خلال محامٍ كفء عند التعامل مع مواقف معينة.